- Free business account with up to 30 DE IBANS

- 5% interest rate on positive balance

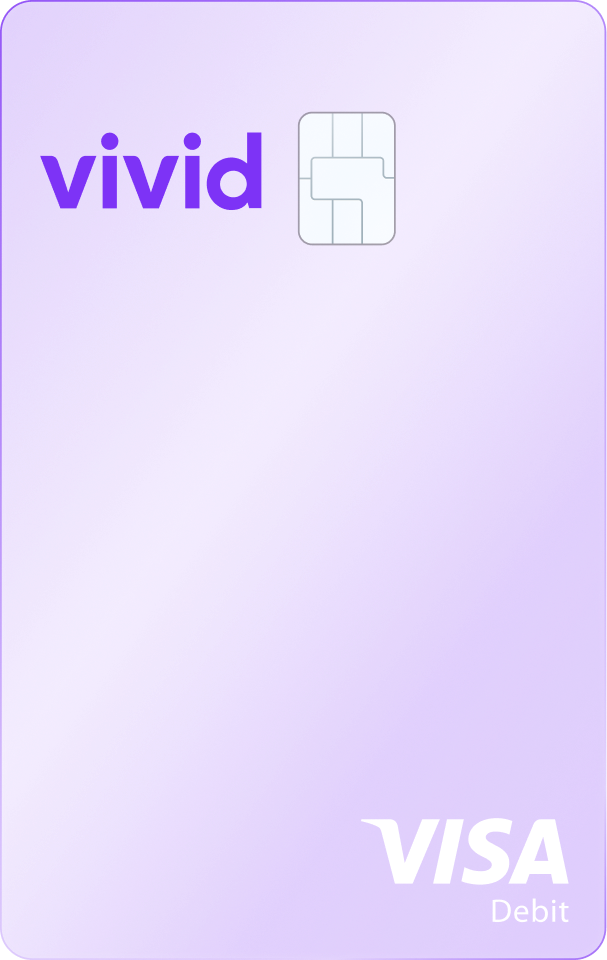

- Free VISA card for every team member

- Instant SEPA and SWIFT transfers

- Team access with personalized permissions

- Personal customer support 24/7

Rated with the highest score “Sehr gut” by Handelsblatt, Germany’s no.1 business and financial journal

Open a business account in minutes with German IBAN.

Get started with our free plan for €0 per month.

Up to 30 accounts with individual DE IBANs are available.

Send and receive payments instantly with SEPA.

Full online registration — no in-person steps.

Make your money work - earn 5% interest annually on a positive account balance in the first 2 months. Add your money to it and earn interest daily. Withdraw funds instantly 24/7, without losing any earned interest.

Earn 3.5% interest annually on a positive account balance after 2 months.

Unlimited free cards - issue as many physical and virtual cards as your business needs for each member of your company.

Get free delivery for the first physical card for each member of your company.

Enjoy up to €100,000 card spending limit to pay for any service online.

Freeze, reissue, and set limits on your cards in a few taps.

Send immediate salary payments to any Vivid account.

Manage your team's access to the accounts.

Decide which team members have permission to execute payments and who needs approval by assigning the Assistant role.

Implement a “four-eyes principle” for secure transactions inside your business.

Get real-time notifications about new payment requests.

Review, approve, and reject team members’ transfer requests.

Export transactional data in either CSV or MT940 format to integrate it into your accounting system.

From there, you can transfer the data to systems such as DATEV, LexOffice, Debitor, etc.

Launch the online application and enter your business details through our guided process. If you have any questions, you can get help in the chat with the account manager.

Pass photo identification via our partners' process on mobile or desktop. No video call is required. You may need to answer additional questions if needed.

Open up to 30 accounts, add team members, top up interest accounts, and earn 5% right away.

Issue free physical cards for your business and customize them with different colors.

Create virtual cards instantly. Set individual limits and get notifications on every transaction. Block any card at any time with one click.

- Annual or monthly basic fee for the account plan.

- Number of employees.

- Costs for virtual or physical cards.

- Number of monthly transactions.

- Costs for each paper-based or paperless booking (transfer, standing order, direct debit).

- Number of cash withdrawals from ATMs.

- Fees for each cash withdrawal from ATMs.

- For a digital account: any charges for accounting functions.

- Fees for international transfers.

- Account management costs.

- GmbH

- GmbH & Co. KG

- AG

- UG

- KG

- eK

- Freelancer

- Sole traders

- 100% online: open your company account in minutes, get a German IBAN instantly, and order your physical or virtual visa cards.

- A digital account in neobanks helps make company accounting easier with automated receipt-matching technology and more.

- Enjoy integrated invoicing, cash flow, and supplier management tools.

- Designed for teams: you can add team members and roles and check and approve each transaction.

- Dedicated customer support: our team is available via chat 7 days a week, 24 hours a day.