What is venture capital?

Are you thinking about starting your own business and wondering how to get the money to transform your ideas into reality? Even the best can't go too far without it. For many, venture capital is the key to receiving the right support to go from vision to execution.

The basics: private equity

Photo by Pixabay

Before digging into the concept of venture capital, it's important to briefly explain what private equity is.

If a company needs capital, it can take out loans, issue stock or sell bonds.

But there's another less conventional option: asking a private equity fund for money. This kind of investment fund invests in or acquires private companies not listed on a public stock exchange. Sometimes they also buy out public companies, take them private and restructure them, working on their potential for future growth. Typically, private equity invests in businesses that are already at a mature stage and in conventional industries and usually get an equity stake back. It's an alternative investment class, and only institutional investors and accredited investors are eligible to put money into a private equity fund.

What is venture capital?

When a company is at an early stage, it rarely can access loans or capital markets directly: that's where venture capital comes into play. Venture capital - also known as VC - is a specific form of private equity that puts money into startups and early-stage emerging companies with big growth potential. The startups sell ownership stakes (usually less than 50%) to venture capital funds and invest the money they get into making the company run until they can make their own money. It's a high-risk investment form that can give back exceptional financial returns, as venture capital funds usually invest in startups and companies with high failure rates.

A venture capital fairytale: Uber

Photo by Jackson David

Two friends, Travis Kalanick and Garrett Camp were attending an annual tech conference in Paris in 2008 and had difficulties finding a taxi. They both realised that technology could come in handy to solve their problem. In 2009, Camp began working on a prototype for UberCab (the original name) as a side project and managed to persuade Kalanick to join as UberCab's "chief incubator". You only needed a tap to order a ride, a GPS was going to identify the location, and the cost was going to be charged to the card on the user account. This was the prototype of something that was about to change every major city's mobility, but to execute their vision, Kalanick and Camp needed money. And that's when venture capital got into the game. Several VC funds over the years loved the idea and flooded the company with cash. Uber went through 8 funding rounds, raising more than $23.9B with the involvement of all the most significant venture capital funds, together with other major companies like Paypal and people like Jeff Bezos.

When these companies thrive, the return for venture capital is so high that it more than compensates for all the money lost in other companies that did not succeed. Think of it like this: if the startup is James Bond, the venture capital fund is Q — giving Bond everything he needs to lead a successful mission. In return, Q gets to share in a bit of the glory. Except in this case, Q is clever and has dozens of agents he's supporting. As long as one of them is successful, he gets the credit, and everyone forgets about the failures.

In August 2009, Uber raised $200k in a Seed Round. The first Uber ride was requested in 2010, and after that, the company received its first significant funding, a $1.25 million round.

How does venture capital work?

Venture capital funds are investors, but where does the money they invest come from? Usually from large institutions like pension funds, financial firms and insurance companies that decide to dedicate a small percentage of their total funds to high-risk investments. As these investments represent a tiny part of the institutional investors' portfolios, venture capitalists can easily decide how to manage the money. The funds are usually structured as limited partnerships, where general partners handle the fund and serve as advisors for the fund's portfolio companies.

They're different from what we call a business angel (or angel investing), which is usually a single person with significant private capital who gets involved in an innovative business or a startup and decides to invest its own money in it. Venture capitalists typically exit the investment through the company listing on the stock exchange, selling to a trade buyer or through a management buyout. Sometimes they sell to other venture capital funds to exit before the IPO. Sometimes another company will buy the company the venture capital is investing in, and that's also a payday. Sometimes venture capitalists receive some return through dividends, but their primary return comes from capital gain when they eventually sell their shares in the company, which usually happens three to seven years after the investment.

Where does VC invest its money?

Photo by RODNAE Productions

From the outside, it might seem that venture capital firms invest in good ideas, but the reality is that they invest in good industries. That's also why their flow of money constantly moves over the years. In the 1980s, for example, 20% of venture capital investments went into the energy industry. At the beginning of 1990, computer hardware was the thing, while later in the same decade, it shifted to CD-ROMs, multimedia and software companies. In 2022, semiconductors, climate tech, defence tech, supply chains, and agriculture are the new deal.

Those changes are not random. The industry segment targeted by venture capital is usually already growing fast and has a capacity that promises to be constrained in the following five years. They avoid investing in technologies and markets that are still very unknown, or in the latest stages of a company, where competitive shakeouts and consolidations are inevitable, and the growth rate slows down.

The relationship between a venture capital fund and a company is something quite unique. If the company looking for capital is a good one, there will be more than one VC looking to invest in it. The VC firm will have to stand out as unique and different thanks to its past investments and success stories, for example, or its area of expertise. At the same time, if the VC is looking at two different companies with more or less the same idea to develop, the VC will invest its money in the company with the best management. Another thing to consider is that, in order for a company to be really successful, a VC fund needs to flood it with money, as it's the only way to wipe the other competitors out.

The stages

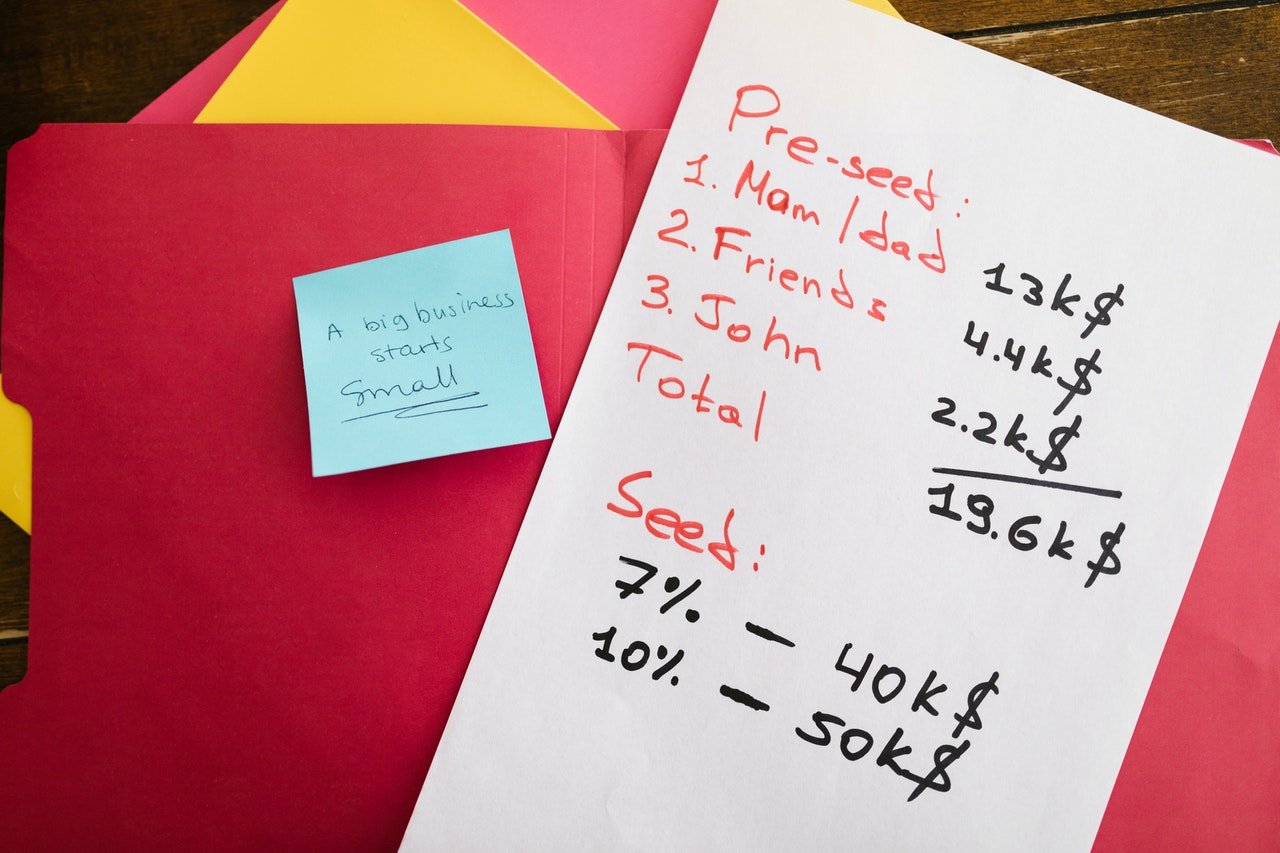

As companies grow and change, they pass through different stages. Some venture capital funds specialise in investing in certain ones, while others participate in all stages.

- Seed round funding: this is the very first round of VC funding. The capital offered to companies is smaller than in the following rounds. It aims to help the company create its own business plan and work on its minimum viable product (MVP). The MVP is a version of a product with just enough features to be usable by early customers, who can then provide feedback for future product development.

- Early stage funding: this involves the series A, series B and series C rounds and the money raised helps the startups going through their first stages of growth.

- Late stage funding: series D, series E and series F are all part of this stage of the business development. At this point, if things are going well, startups are generating revenue and showing growth. Even if the company is not yet profitable, the future looks promising.

Where is my happily ever after?

Let's go back to Uber, the perfect example of how this system actually works. By June 2022, the company is still not profitable despite even going public. So, how did they survive until today? By injecting money into their own bloodstream. Being fully financed by VC's money and not needing to make revenue before their IPO, Uber could maintain extremely low fares, which literally killed the taxi industry. And the more Uber was growing, the more the company valuation was growing, the easier it was to get more money. It's still unclear how this model might be sustainable in the long run. Uber managed to maintain very low fares because of the possibility of using VC's money, but at one point the money will be over, and they will have to become profitable. This could explain why Uber rides are not so cheap anymore - together with the fact that drivers started rebelling against the system and fighting to earn more.

It's a system that works well for the players it serves: entrepreneurs who need funding, investors who want high returns, investment bankers who need companies to sell and venture capitalists who make money for themselves by creating a market for the other three.

Any opinions, news, research, analyses, or other information contained on this website are provided as general market commentary, and do not constitute investment advice, recommendations nor should be perceived as (independent) investment research. The author or authors are employed by Vivid and may be privately invested in one or several securities mentioned in an article. Vivid Invest GmbH offers as a tied agent of CM-Equity AG the brokerage of transactions on the purchase and sale of financial instruments with the exception of those in the area of foreign exchange brokered by Vivid Money GmbH.