Best Business Account 2026

Best Business Account 2026Finanzfluss.de

Best Business Account 2026Finanzfluss.de Highest Interest Rate for Business 2026Für-Gründer.de

Highest Interest Rate for Business 2026Für-Gründer.de No. 1 Business Investment Account 2026Geschaeftskonten24.net

No. 1 Business Investment Account 2026Geschaeftskonten24.net Top Mobile Banking 2025Handelsblatt.com

Top Mobile Banking 2025Handelsblatt.com- Trustpilot: Excellent!

Best Business Account 2026Finanzfluss.de

Best Business Account 2026Finanzfluss.de Highest Interest Rate for Business 2026Für-Gründer.de

Highest Interest Rate for Business 2026Für-Gründer.de No. 1 Business Investment Account 2026Geschaeftskonten24.net

No. 1 Business Investment Account 2026Geschaeftskonten24.net Top Mobile Banking 2025Handelsblatt.com

Top Mobile Banking 2025Handelsblatt.com- Trustpilot: Excellent!

Free account with unlimited IBANs

Integrations with accounting software

4% p.a. interest rate on positive balance

Cashback on card purchases with the free Visa cards for team members

SWIFT and SEPA instant transfers

- Open a business account

Up to 10 % cashback help you cut business expenses

Issue a free card for every team member. Pick your favourite cashback categories for the upcoming month.

All purchases, up to 1% Guaranteed unlimited cashback on all purchases, excl. ATM withdrawals and SEPA transfers.

Facebook advertising, up to 10% Purchases of Facebook advertising.

Amazon, up to 10% Purchases on Amazon.

Google advertising, up to 10% Purchases of Google advertising.

More categories Pick your favourite cashback categories every month.

All-in-One Business Account

Earn 4% interest annually

Keep your uninvested cash in your Interest Account and earn 4% per year for the first 4 months. When the promo period is over, you earn up to 2%*.

Access to your money any time

Top-up and withdraw your funds any day, any time.* Money is immediately available upon withdrawal to your Business account.

We keep your money safe

To protect your money while offering a good return, we invest your money in Money Market Funds (MMF). All the funds we use have AAA/Aaa ratings from rating agencies such as S&P and Moody's and Fitch. Read more about how Vivid safeguards your funds here.

Main account

€134,000.00

IBAN • 4565

Employees

€4,906.00

IBAN • 1337

Taxes, Employee benefits, Payroll

€11,700.00

IBAN • 1620

Savings

€1890.00

IBAN • 1890

Free account with unlimited IBANs

Fully digital registration — no in-person verification needed. 24/7 support: everyone’s situation is unique, and we consider each onboarding case individually.

Fast transfers and SEPA direct debits

Receiving and sending money is made easy via SEPA Instant and SWIFT transfers. Redirecting your direct debits from your current bank to Vivid goes quick - no extra costs involved.

within monthly limits

Free physical and virtual cards

Free delivery of the first physical card for each member of your company. High spending limits on each card to match your needs.

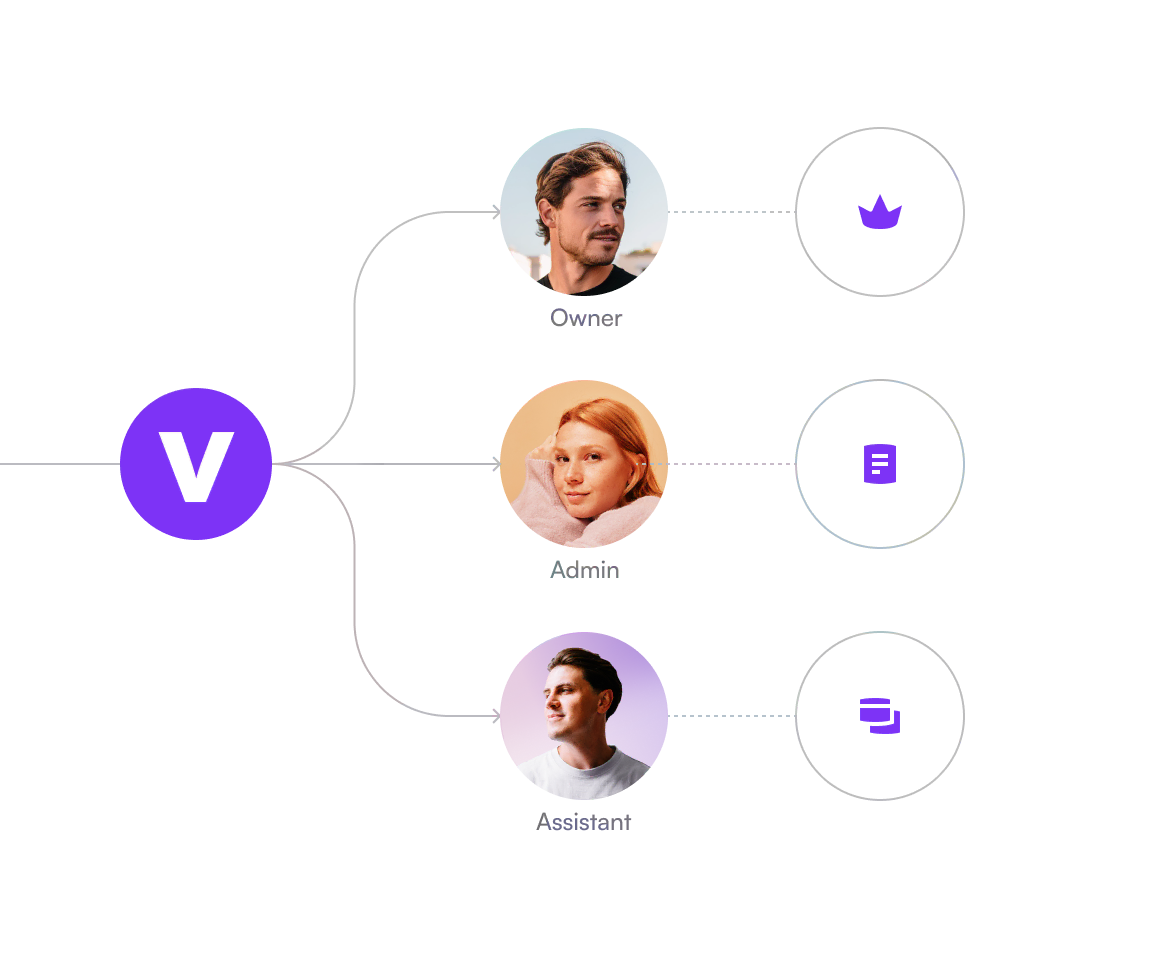

Team access with personalized permissions

Assign Admin roles to employees for full access to the account, and Assistant roles to external accountants and employees for limited access.

Integrations with accounting software

Sync your transactions and bank statements with platforms like DATEV, sevDesk, and others. Stay updated without manual data entry, making expense tracking and tax prep easier.

Lexware Office (ex-lexoffice) (transactions)

German software with vast features for accounting, invoicing and payroll

Lexware Office (ex-lexoffice) (documents)

German software with vast features for accounting, invoicing and payroll

DATEV (transactions)

German software with vast features for accounting, invoicing and payroll

DATEV (documents)

German software with vast features for accounting, invoicing and payroll

sevDesk

Online software with vast features for accounting and invoicing, available in several languages

Оdoo

Odoo is a user-friendly financial management tool that simplifies invoicing, bookkeeping, and reporting for businesses

Sorted

Digital platform for streamlined document organization, workflow automation, and tax-related file management.

Sage

Solutions for invoicing, expense tracking, bank reconciliation, payroll processing, financial reporting, and tax compliance.

BuchhaltungsButler

German online-software for accounting, invoicing and financial analysis

FastBill

German online-software for accounting, invoicing and financial analysis

easybill

German online-software for invoicing and stock management

Puls Project

German online-software for cashflow planning and management of several bank accounts

Agenda

Integrated business software for accounting, payroll, HR, tax calculation, invoicing, and document management

Addison

Workflow‑oriented accounting and tax management solution with finance, payroll, controlling, invoicing, and document handling.

Commitly

German online-software for cashflow planning

GetMyInvoices

German online-software that automatically collects invoices from online portals, inboxes and scans

Wiso Steuer

Tax software for quick filing, accurate income reporting, smart optimization, and secure document submission.

Finanzguru

German application that supports in tracking and analising finances

BMD

Integrated business software for accounting, document management, HR, and ERP, with powerful automation and cloud access

MoneyMoney

German software designed specifically for macOS to manage and analise several bank accounts

Mobile app

Organise your budget and payments by opening multiple accounts with separate IBANs. Send money in a few taps. Issue, customise, freeze and manage your virtual and physical cards in your app.

Web app — for business accounts

Oversee your personal and business accounts in the same mobile app—switch between them seamlessly. Use our web app to conveniently manage your business account from your computer.

Open a business accountOrganise your budget and payments by opening multiple accounts with separate IBANs. Send money in a few taps. Issue, customise, freeze and manage your virtual and physical cards in your app.

Get the app

Superior payment security

We comply with the Payment Card Industry Data Security Standards to protect your payment information.

2-step authentication

With 3D Secure and two-step authentication we ensure no payment is made without your authorisation.

GDPR compliance

Our servers are securely hosted in the European Union, ensuring full compliance with GDPR regulations.

Plans

Best for growing companies with more activity and advanced needs — built to keep fast teams in sync

- Get started

Free Start

Perfect for newly registered companies setting up finances and trying key banking features for free

0 € / month

Free of charge at all times- Accounts & Interest

- Free accounts with German IBANsUnlimited

- Initial fixed interest rate p.a.*4%

- Fixed interest rate p.a. after 4 months*0,1%

- Cards & Cashback

- Guaranteed unlimited cashback0,1%

- Cashback on selected categories and brands, up to2%

- Virtual and physical cardsFree

- Card spending limits for ads & IT servicesUnlimited

- Transfers

- SEPA InstantFree

- Incoming SWIFTFree

- Outgoing SWIFT5 €

- Support

- 24/7 human supportYes

- Dedicated customer success teamNo

- Accounts & Interest

- Get started

Basic

Ideal for small businesses with steady transactions needing reliable everyday banking at low cost

6,9 € / monthexcl. VAT

2 months free trial- Accounts & Interest

- Free accounts with German IBANsUnlimited

- Initial fixed interest rate p.a.*4%

- Fixed interest rate p.a. after 4 months*0,5%

- Cards & Cashback

- Guaranteed unlimited cashback0,2%

- Cashback on selected categories and brands, up to4%

- Virtual and physical cardsFree

- Card spending limits for ads & IT servicesUnlimited

- Transfers

- SEPA InstantFree

- Incoming SWIFTFree

- Outgoing SWIFT5 free per month, then 5 €

- Support

- 24/7 human supportYes

- Dedicated customer success teamNo

- Accounts & Interest

- Get started

Pro

Best for growing companies with more activity and advanced needs — built to keep fast teams in sync

18,9 € / monthexcl. VAT

2 months free trial- Accounts & Interest

- Free accounts with German IBANsUnlimited

- Initial fixed interest rate p.a.*4%

- Fixed interest rate p.a. after 4 months*1,3%

- Cards & Cashback

- Guaranteed unlimited cashback0,5%

- Cashback on selected categories and brands, up to6%

- Virtual and physical cardsFree

- Card spending limits for ads & IT servicesUnlimited

- Transfers

- SEPA InstantFree

- Incoming SWIFTFree

- Outgoing SWIFT10 free per month, then 5 €

- Support

- 24/7 human supportYes

- Dedicated customer success teamYes

- Accounts & Interest

- InvoicingFree

- Document uploads for bookkeeping (on every paid plan)Unlimited

- Integrations (sevDesk, Lexware Office, DATEV, ...)Free

- Business travel cashback up to30%

- Crypto Earn rewards up to8% APY

- Maximum loan amount & repayment term200,000 €,

12 months - Fee for receiving card payments from clients (EEA cards), from0,79% (+0,25 €)

- Treasury (stocks, ETFs, crypto)Free

- Tax filing (for freelancers)Free

- Certified tax adviser (for freelancers)99 € per month

or 990 € per year - POS terminalFree

- Flat transaction fee (all cards)Up to 1.49%

- Digital employees (personal and legal AI assistants)Free

Your money is safe with us

Safely stored

Your funds are placed in assets like deposits with the Central Bank of Luxembourg and high-quality Qualifying Money Market Funds (QMMFs), managed by BlackRock and others. Unlike traditional banks, we don’t use client funds for risky loans.

Overseen by European financial authorities

All our services are provided by the Vivid Money group: Vivid Money SA is regulated by the Commission de Surveillance du Secteur Financier (CSSF) of Luxembourg and Vivid Money B.V. is regulated by the Dutch Authority for Financial Markets (AFM).

Secured against our insolvency

Your funds are kept separate from our own. In the unlikely event of Vivid Money SA or Vivid Money B.V. becoming insolvent, our customers' money remains safe — even beyond €100,000. The funds in your account are yours, and yours alone.