Interest Rate Pocket

Let your money work for you: Earn 3% fixed interest

Earn interest every day

Returns are added to the Interest Rate Pocket every business day — and you can access them right away. Don’t freeze your money with old-fashioned fixed term saving products.

No fees

Top up, withdraw, and hold your uninvested cash with zero fees.

No minimum balance requirements

Deposit as little as 0,01 € to start earning fixed interest on your uninvested cash.

Instant access to your cash*

Transfer in one click to your card and instantly use for purchases, if you keep your funds in the uninvested cash.

0% fee. Even for past purchases.

Learn more →

We keep your money safe

To protect your money while offering a good return, we invest your money in Money Market Funds (MMF). All the funds we use have AAAm (S&P), Aaa-mf (Moody’s), or AAA/mmf (Fitch) ratings from rating agencies.

Authorised by the AFM

Vivid Money B.V., part of Vivid group, is authorised and regulated as an investment firm by the Dutch Authority for the Financial Markets (AFM).

Your investments are safeguarded

Your investments are protected under the Dutch Investor Compensation Scheme up to €20,000. Please read the specific conditions that apply.

Your money is in safe hands

We keep your funds separate from our own assets to ensure that they are safe even in the event of our bankruptcy.

Investing always involves risks and your initial investment amount cannot be guaranteed. You can find more information about Money Market Funds and the risks of investing in financial instruments here.

Here is how you start

1

Open your account

Open your Vivid account in 5 mins. Create your Interest Rate Pocket on the Pockets screen in the app.

2

Top up your Pocket

Make a deposit of minimum 0,01€

3

Start earning fixed interest

Watch your money work for you.

4

Explore more options

to generate yield

Invest in Money Market Funds to earn a variable rate.

Money Market Funds

Invest in Money Market Funds (MMFs) by yourself with the Interest Rate Pocket. MMFs are investment funds that typically consist of a diverse selection of short-term financial instruments such as bonds issued by the governments.

4.36%

Variable rate

BlackRock ICS USD Government Liquidity Fund

2.47%

Variable rate

BlackRock ICS Euro Government Liquidity Fund

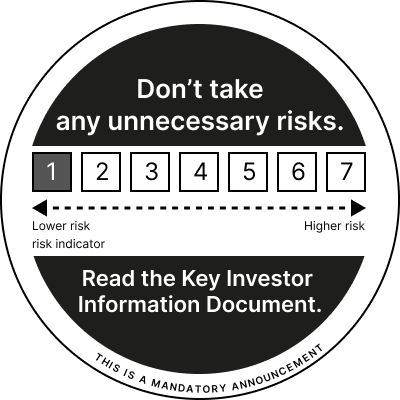

Risk Indicator

Interest rate is a 30-day yield as of 14 March 2025. Interest rates displayed are applicable to the Prime plan. See the plan overview for service fees.

Growth is not guaranteed. Investing always involves risks.

With Vivid NL Money B.V. (“Vivid NL”) you make your own (investment) decisions at your own risk and initiate actions based on your own judgment. Any investment is always associated with risks. The value of investments may fluctuate, meaning that it can go up as well as down, and you could get back less than your original investment, or even lose your entire investment or more. Higher risk is often linked to investments with higher expected returns. Please refer to the Risk Brochure where we provide an overview of the risks you take when using our investment services and investment products. Consider whether you are willing to take these risks and whether you can afford them.

Questions?

How to find IBAN number?

Your IBAN number can typically be found on your bank statement or via your online banking system. Alternatively, an IBAN calculator can generate your number based on your local bank details.

Is IBAN and SWIFT code the same?

IBAN and SWIFT code are not the same. The IBAN identifies a specific bank account for international transactions, while the SWIFT code identifies the bank itself.

How many digits in an IBAN number?

IBAN number can have up to 34 alphanumeric characters. This includes a country code, check digits, and a domestic bank account number.